Ira Phase Out Limits 2025

BlogIra Phase Out Limits 2025. $143,000 (in 2025) married filing separately. Ira contribution limits for 2025 and 2025.

The maximum total annual contribution for all your iras (traditional and roth) combined is: $143,000 (in 2025) married filing separately.

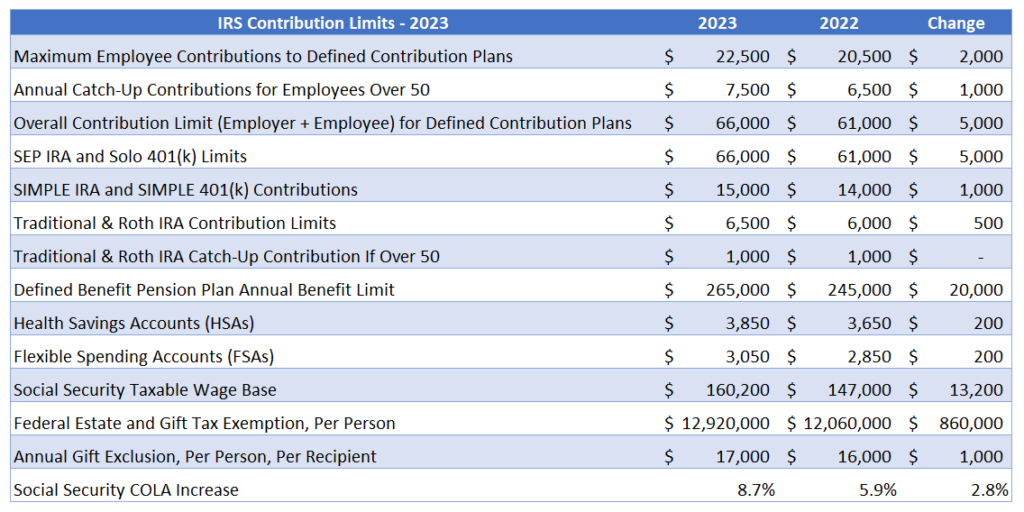

Ira Limits 2025 For Simple Ira Isabel Aubrette, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year was $6,500 or $7,500 if you were.

2025 Roth Ira Limits Phase Out Minda Fayette, If you have roth iras, your income could affect how much you can contribute.

Roth Contribution Limits 2025 Irs Meryl Suellen, Here are the roth ira income limits for 2025, as well as how to calculate your magi to figure out if you qualify.

Ira Limits 2025 For Separately Hana Carissa, Your personal roth ira contribution limit, or eligibility to contribute at all, is dictated by your income level.

Irs Roth Ira Contribution Limits 2025 Essy Susannah, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year was $6,500 or $7,500 if you were.

Roth Ira Contribution Limits 2025 Irs Romy Mariam, If you're age 50 and older, you can add an extra $1,000 per year in.

Tsp Roth Ira Contribution Limits 2025 Athene Veronika, Ira contribution limits for 2025 and 2025.

Roth Ira Contribution Limits 2025 Calculator Zenia Kellyann, $7,500 (for 2025) and $8,000 (for 2025) if you're age 50 or older.